LTC Price Prediction: Will Litecoin Hold $100 Support Amid Technical Pressure?

#LTC

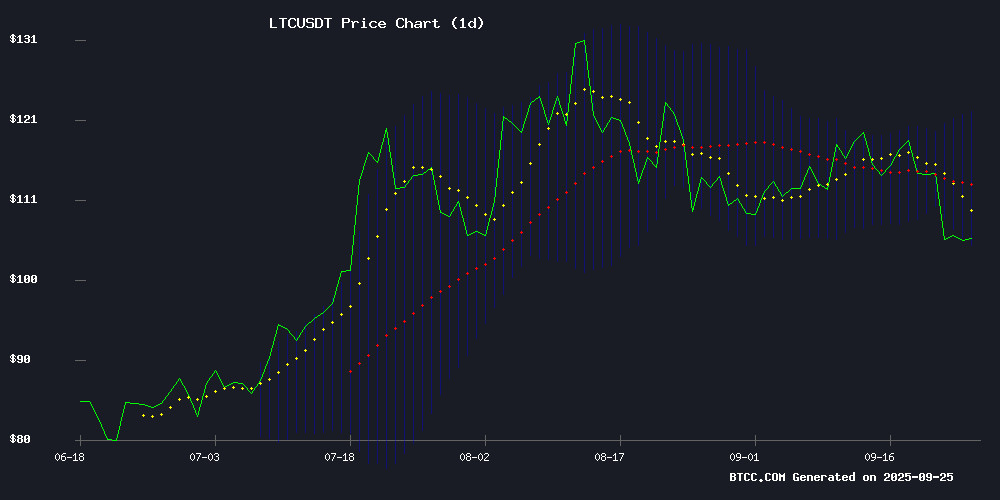

- LTC trading below key moving average indicates bearish momentum

- Oversold Bollinger Band position suggests potential support near current levels

- Mixed market sentiment with limited positive catalysts for near-term recovery

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

LTC is currently trading at $102.30, significantly below its 20-day moving average of $113.15, indicating bearish momentum. The MACD shows a positive histogram of 2.07, suggesting some buying pressure, but remains weak relative to recent price action. Bollinger Bands position LTC NEAR the lower band at $103.92, signaling potential oversold conditions. According to BTCC financial analyst Robert, 'The breach below the 20-day MA and proximity to the lower Bollinger Band suggest continued downward pressure, with the $100 psychological level becoming a critical support zone.'

Market Sentiment: Litecoin Faces Headwinds Amid Broader Crypto Focus

Current news flow highlights Litecoin struggling at the $114 resistance level while other cryptocurrencies like XRP and BlockDAG capture market attention. Institutional interest appears concentrated on XRP amid political speculation, leaving LTC with reduced momentum. BTCC financial analyst Robert notes, 'The lack of positive catalyst coverage for Litecoin in current headlines, combined with its technical struggles, creates a challenging environment for near-term price appreciation. Market sentiment remains cautious as LTC battles key resistance levels.'

Factors Influencing LTC's Price

XRP Holds $3, Litecoin Struggles at $114, and BlockDAG Surges Past $410M

XRP's market stability hinges on ETF developments and regulatory clarity as it maintains a $3 price level. Meanwhile, Litecoin faces resistance at $127–135, with potential downside risk to $110 if momentum falters.

BlockDAG emerges as the standout performer, raising over $410 million in its presale—including $40 million in the past month alone. The project now boasts 312,000 holders, 3 million mobile miners, and global distribution across 130+ countries. Retail investors have led the charge, but institutional interest is growing as adoption metrics prove undeniable.

Litecoin, SUI, HBAR, and Remittix: High-Potential Cryptos in Focus

Investors are actively scouting for the next major crypto rally, with payment rails, throughput, and utility driving the conversation. Litecoin, SUI, HBAR, and emerging PayFi project Remittix are drawing attention as potential high-multiplier plays.

Litecoin, trading between $106-$107, remains a steady contender with on-chain activity and MWEB wallet adoption fueling optimism. A push toward $120-$130 is plausible if market conditions improve, though its established profile may limit explosive upside compared to newer payment-focused tokens.

SUI faces a tug-of-war at $3.33-$3.40 after a sharp pullback. Bulls point to record transaction speeds and growing TVL, while resistance NEAR $3.60-$3.70 looms. Holding above $3.20 could pave the way for a retest of $4.00.

HBAR's enterprise-grade throughput (10,000+ TPS) and tokenization capabilities position it as a long-term bet, though its $0.22 price reflects patient capital requirements. Meanwhile, Remittix—priced below $1—is gaining traction with its live wallet beta and impending exchange listings, sparking speculation of a 50x surge.

Institutional Investors Flood XRP Amid Trump Crypto Policy Speculation

XRP is witnessing unprecedented institutional inflows, with $69.4 million recorded in weekly investments—a stark contrast to outflows in other digital assets. The surge coincides with growing speculation around former President Donald Trump's anticipated crypto policy announcement, suggesting institutional players are positioning for regulatory clarity rather than uncertainty.

CoinShares data reveals XRP's dominance as multi-asset products shed $38 million and rivals like Litecoin and Cardano saw minimal traction. Market observers interpret this as a calculated bet on XRP's regulatory positioning, particularly as political narratives around cryptocurrency gain momentum.

Will LTC Price Hit 100?

Based on current technical indicators and market sentiment, LTC is already trading near the $100 level at $102.30 and shows strong likelihood of testing this psychological support. The technical setup presents mixed signals:

| Indicator | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $102.30 vs $113.15 | Bearish |

| Bollinger Band Position | Near Lower Band ($103.92) | Oversold |

| MACD Histogram | +2.07 | Weak Bullish |

BTCC financial analyst Robert observes, 'With LTC trading just $2.30 above $100 and showing technical weakness, a test of this level appears probable. However, oversold conditions near the Bollinger lower band may provide some temporary support.' The convergence of technical pressure and neutral-to-negative market sentiment suggests the $100 level will likely be tested in the coming sessions.